The year 1966 was a watershed moment for the credit union movement in Australia. According to data from the Australian Mutuals Archives, 63 credit unions were formed in that single year. While the landmark Credit Union Act (NSW) was still three years away and federal income tax exemptions wouldn’t arrive until 1974, momentum was building.

“The 1960s represented a period of great grassroots mobilisation,” explains Australian Mutuals Archives archivist Ben Woods.

“Communities and workplace groups were no longer content with the limited financial options offered by traditional banks. They began pooling their resources to create something entirely different: financial institutions owned by their members, dedicated to mutual benefit rather than corporate profit.”

This surge of interest was fuelled in part by a 1962 television interview with Stan Arneil – a war hero, author, and tireless credit union advocate – on Michael Charlton’s Four Corners program. Arneil’s passion for industrial and employee credit unions captured the public imagination.

The impact was profound: in the decade leading up to 1975, the number of credit unions in Australia grew from 342 to 748. Membership skyrocketed from 170,000 to 910,000, with two-thirds of this growth concentrated in New South Wales. During this era, credit unions were the fastest-growing financial institutions in the country.

Today, as we look toward 2026, Australian Mutuals Archives highlight three COBA members reaching their diamond jubilee – 60 years of service and commitment to their members.

Central West Credit Union

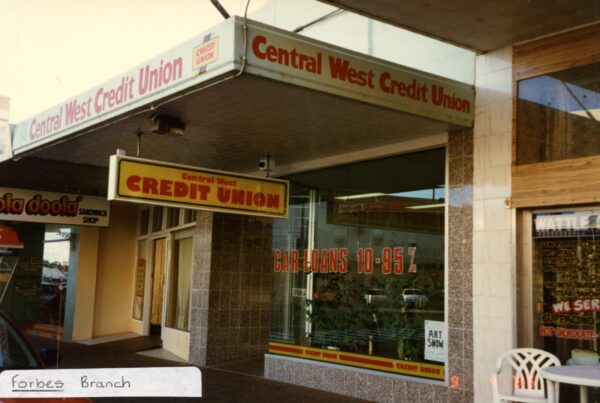

Born from the dedication of public servants in Parkes, NSW, Central West Credit Union was registered in October 1966 as the Central West County Council Employees Credit Union. By 1970, it had evolved into Central West Credit Union, later merging with the Parkes Industries Employees Credit Union in 1980.

Central West has been a leader in preserving and sharing its rich history. Their archives are a treasure trove of the movement’s local history, featuring every annual report since 1967, oral histories from long-serving staff and directors, and the commemorative book Central West Credit Union Limited: 30 Years of Service 1966-1996. This commitment to their heritage ensures that the stories of the members who built the institution are never forgotten.

Coastline Bank

Coastline Bank’s journey is a classic example of the evolution from an industrial credit union to a community pillar. Originally registered in November 1966 as the MRCC Employees Credit Union in Kempsey, it transitioned to Macleay Mutual Credit Union in 1970 to better serve the broader Mid-North Coast community.

The name Coastline Credit Union was adopted in 1995 to reflect its deepening roots across the region. In February 2025, the institution entered a new chapter by trading as Coastline Bank. Throughout these changes, their focus has remained on the people of the Macleay Valley. Their historical records – including newsletters, news clippings, and an oral history with a Director—tell a story of growth that never sacrificed its small-town heart.

Teachers Mutual Bank

Teachers Mutual Bank began in 1966 as the Hornsby Teachers Association Credit Union. Its rapid expansion was triggered by a specific condition: to gain authority for payroll deductions from the Department of Education, membership had to be opened to all teachers in NSW. Consequently, members voted to become the N.S.W. Teachers Credit Union at their first AGM in 1967.

From those early days of processing transactions in school staffrooms, TMB has transformed into a major force in the mutual sector. It achieved bank status in 2012 and has since grown through the creation of specialised brands like UniBank, Firefighters Mutual Bank, and Health Professionals Bank. Despite its scale, TMB continues to champion the same mutual values that the Hornsby teachers envisioned six decades ago.

The history of these institutions is a testament to the enduring power of the customer-owned model. As they celebrate 60 years in 2026, they remind us that when people come together for their mutual benefit, they can build something that lasts.

To explore the history of these mutuals and others, visit Australian Mutuals Archives.